When you visit a doctor or hospital, they work with Blue KC to file a claim on your behalf. These claims are outlined on your Explanation of Benefits – or EOB.

Your EOB is a go-to reference for important information like how much of your care was covered and how much you may still need to pay.

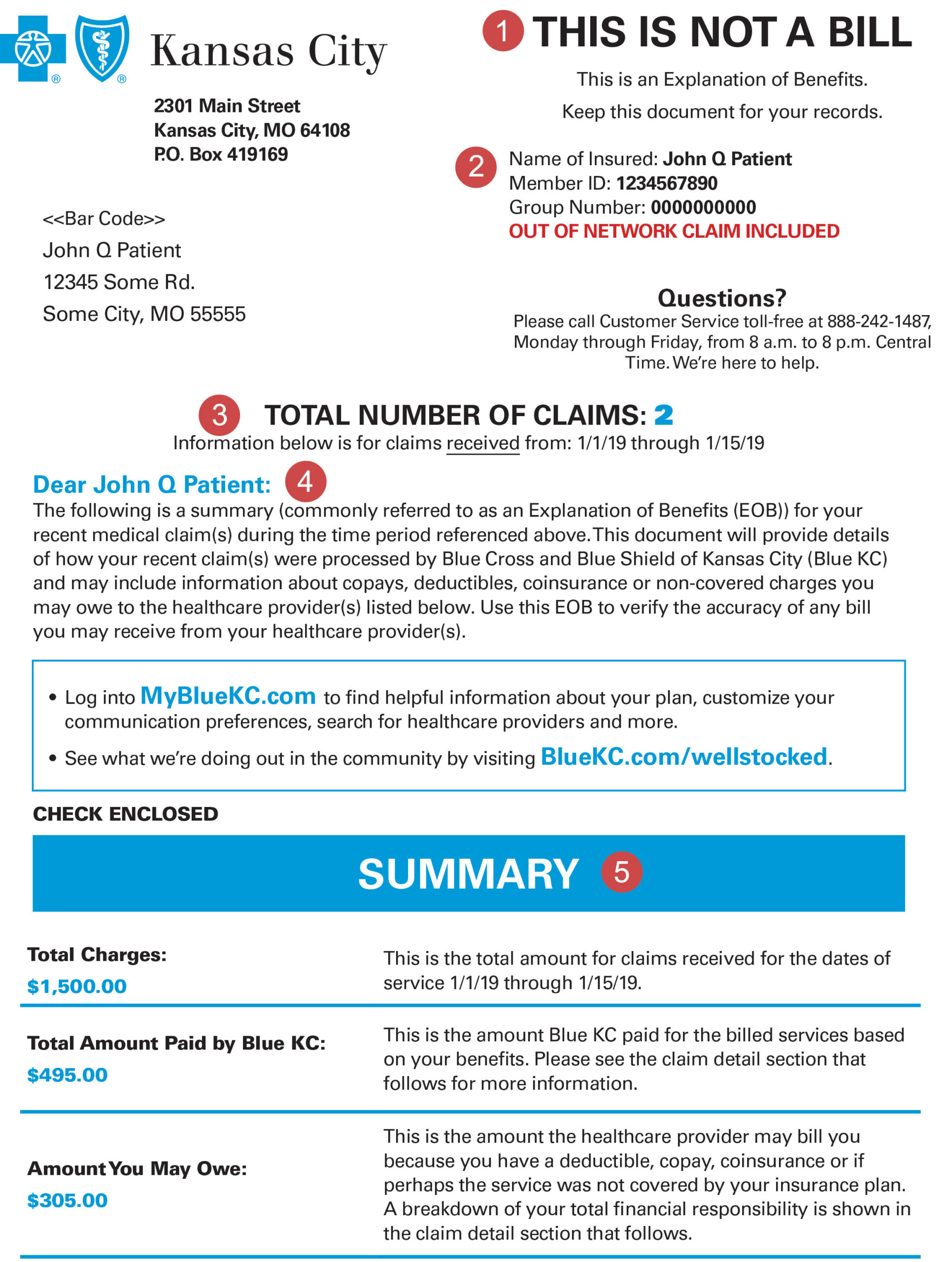

Your EOB

We make it easy for you to find the information you need on your EOB. Check it out.

- A simplified summary providing high-level claim details.

- An easy-to-read, detailed breakdown of claim(s) that highlights your Blue KC discount, what Blue KC is covering, your copay, and more.

- A section that highlights your Blue KC savings.

- Deductible and maximum out-of-pocket summaries that provide information in a format that’s similar to what you’ll see online.

- Plus, Blue KC will generate EOBs within around 14 days of a claim being processed instead of every time a claim is processed. If multiple claims come in during that window of time, they’ll be included on the same EOB. This will keep you in the know and save paper.

Let’s zoom in on the details:

1: This is Not a Bill: Your EOB is documentation of how Blue KC has processed your claim. If you do receive a bill from your provider, you can use your EOB to ensure the amount billed is correct based on your Blue KC coverage.

2: Member Information: Information about you and your insurance coverage. If an out-of-network claim has been filed, it is clearly noted here.

3: Total Number of Claims: Information about your recent claim(s) within the time period are outlined here.

4: Narrative: A brief overview of how your claim was processed.

5: Summary: A simple overview to show how your claim is paid.

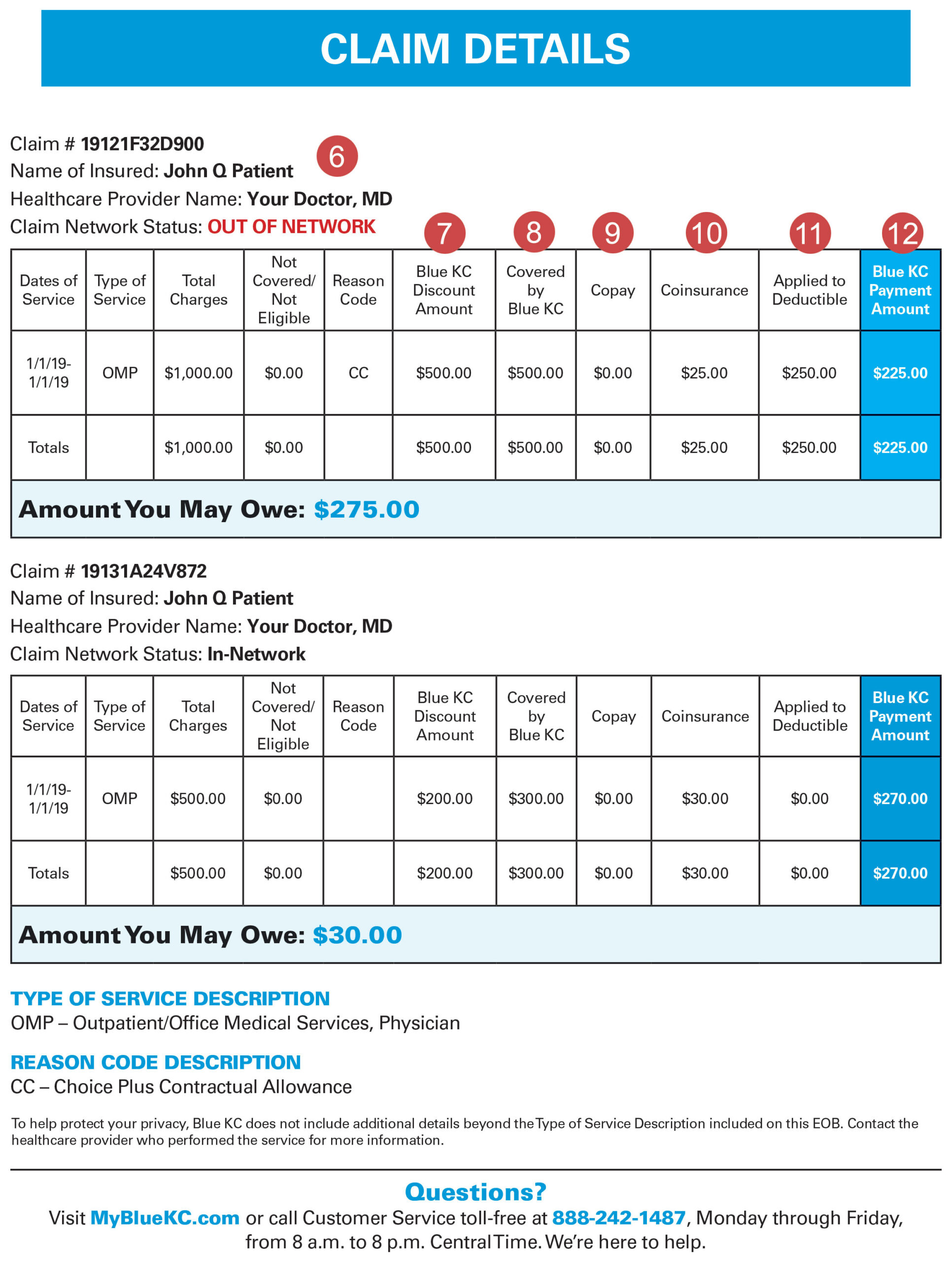

6: Claim Details: This area combines critical payment information into one convenient summary. It clearly outlines the Blue KC negotiated savings as well as any fees and services for which you are responsible.

7: Blue KC Discount Amount: Blue KC has negotiated these savings with providers on your behalf. This is one of the most valuable aspects of having coverage with Blue KC.

8: Covered by Blue KC: This is the total of the claim after all discounts and other reductions. Deductible and coinsurance amounts are calculated from this figure.

9: Copay: The amount a member must pay each time a specific covered service is received, if your policy includes copayments.

10: Coinsurance: The percentage of an allowable charge you must pay for a covered service. Generally, you must meet the deductible before your coinsurance applies.

11: Applied to Deductible: The portion of the claim being applied to your plan deductible. You must pay this amount before benefits become payable by Blue KC.

12: Blue KC Payment Amount: This is the amount that Blue KC will pay to the provider or member for the claim.

13: Annual Usage: This area documents what your deductible status was at the time the claim was processed. Many times, this information will be outdated by the time you receive an EOB. You can get your most recent deductible information in your member portal at MyBlueKC.com under the Claims & Usage section.

14: Savings Provided by Blue KC: This is the total amount you’ve saved as a Blue KC member.

Choose how to get your EOBs

Your EOBs are available on the member portal at MyBlueKC.com under “Claims & Usage”. You can also sign up for paperless EOBs in the “Communications” section here: https://members.bluekc.com/profile/communication-preferences